GST Act mostly requires for uniform indirect taxes in India and believes that One nation one Tax. There is the different-2 type of indirect taxes in the country and states.

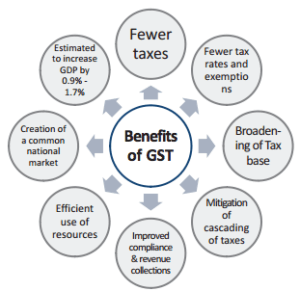

The main benefits of GST Act on taxpayers are:

Single taxation makes India as one market, goods, and services at one rate in all over India help manufacturers as reducing taxation in them. Aside from full remittance of credit, there are a few different benefits of GST in India.

I am mentioning the advantages of GST Bill as under-

1.Reduction in costs:

Due to full and consistent credit, makers or merchants do not need to incorporate expenses as a piece of their expense of creation. Which is a major motivation to say that we can see diminished in costs?

2.Fewer Taxes:

With the implementation of GST in India, one of the advantages of GST bill for Taxpayers is that they have to pay lesser taxes like Service Tax, octroi tax, Excise Tax, sales tax, central sales tax and may more.

3.The increase in Government Revenues:

This may appear to be somewhat unclear. In any case, even at the season of presentation of VAT, general society incomes really went up as opposed to falling in light of the fact that numerous individuals turned to paying expenses instead of sidestepping the same.

Notwithstanding, the legislature may wish to present GST at a Revenue Neutral Rate, in which case the incomes won’t see a noteworthy increment in the short run. We have to see whether this will be a benefit of GST or not.

4.Less consistency and procedural expense:

Instead of keeping up enormous records, returns and reporting under different diverse statutes. All assesses will discover agreeable under GST as the consistency expense will be lessened. It ought to be noticed that assesses are by and by, required to keep a record of CGST, SGST, and IGST independently. This is the main benefit of goods and services tax for a common person.

5.Move towards a Unified GST:

Internationally, the new taxation act is constantly favoring in a

bound together frame (that is a single taxation for the entire country, rather than the double taxation position). In spite of the fact, that India is embracing Dual GST investigating the government structure. It is still a decent move towards a Unified GST, which viewed as the best strategy for Indirect Taxes.

Read here: Main Points on benefits of GST on Taxpayers the GST is a decent sort of assessment. In any case, for the effective execution of the same, we should be mindful around a couple of perspectives.

Taking after are portions of the elements that must remember about GST?

- Firstly, it truly requires that every one of the states execute the GST together and that too at the same rates. Else, it will be truly unwieldy for Businessman to consent to the procurement of the law. Further, GST act will be exceptionally favorable if the rates are same, because overall charges will not be a component in speculation area choices, and individuals will have the capacity to concentrate on productivity and will benefit by this act.

- For smooth working, it is essential that the GST plainly set out the assessable occasion. In the blink of an eye, the CENVAT credit managers, the Point of Taxation Rules corrected, presented for this reason as it were. Nevertheless, the principles ought to be more refined and free from equivocalness.

- The GST Act is a destination base assessment, not the production one. In such circumstances, it ought to be obviously identifiable as to where the products are going might be troublesome if there should be an occurrence of administrations. The government has to do his best to make GST beneficial for Taxpayers.

- More mindfulness about GST and its favorable circumstances must make, and experts like us truly need to take the onus to accept this obligation.

There are many other advantages of GST bill on a taxpayer. Which we come to know later. However, there are as well some disadvantages of this act, which will reveal after implication of the same.

Also Read

Taxation on Business in India Advantages and Disadvantages of GST Bill