Are you ready to showcase your brand to a diverse audience passionate about beauty and wellness?

The beauty and welfare industry is flourishing in modern times, with many people starting their businesses. Some individuals create tutorial videos to teach others about beauty techniques and then establish their institutes. Others develop their beauty product lines and launch their own companies. A woman’s beauty is often said to be her most precious asset.

Keeping these in mind, India International Beauty & Wellness Fair organized a Two day expo at its Bombay Exhibition Centre, Mumbai. All businessmen, influencers etc… related to beauty and wellness should participate.

PREMIER EVENT FOR THE BEAUTY & WELLNESS INDUSTRY IN INDIA

JOIN INDIA INTERNATIONAL BEAUTY & WELLNESS FAIR 2024

Explore a vast collection of popular brands and emerging artists in skincare makeup haircare spa wellness and more. This is marketing by Franchise Batao.

Date:- 18-19 March 2024

Timing:- 10 am – 7 pm

Venue:- Bombay Exhibition Centre NESCO Goregaon.

Why you should exhibit

- Showcase your brand

- Launch new products and services

- engage in knowledge sessions

- Access to decision-makers

- Media Coverage and PR opportunities

- Maximum visibility

- Networking opportunities

- Generate leads and drive sales

India International Beauty & Wellness Fair Highlights

- Fashion Shows

- Live Demonstration

- Meet the celebrities

- Seminars/Conferences

- Product Launch

- Awards Shows

Book your stall at INDIA INTERNATIONAL BEAUTY & WELLNESS FAIR

For exhibitor registration click here https://forms.gle/X4PY4mee492nawC5A

For stall bookings and inquiries, please contact:: 9811749170

Suggested Blog:-

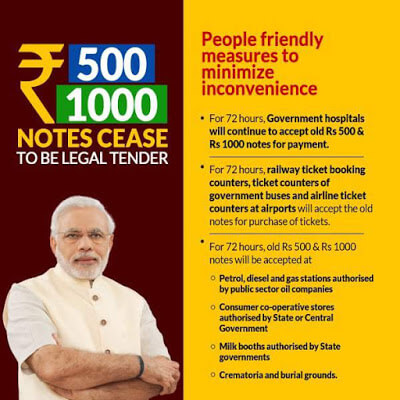

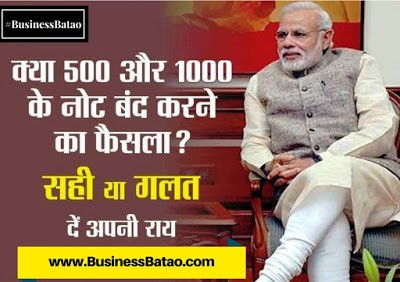

Indians have fear to go to the banks. This is a big limitation of cashless transactions and cashless economy.

Indians have fear to go to the banks. This is a big limitation of cashless transactions and cashless economy.