Effects of GST on products and Services: We all are very happy that GST is going to applicable soon in India. However, do we know what the effect of GST on Products and Services is?

At present when there is no GST, we are paying different taxes on product and services wise but with the GST, all will tax in the same manner.

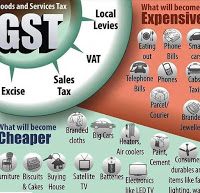

Thus, the Products and Services that taxed at a lower rate will be costlier after the GST. The Products that where there are high tax rates will be cheaper with GST effect.

Currently, there are 119 Services, which covered under service Tax act, and the rate of service Tax is 15%. Nevertheless, it expected that the GST rate will be 18-20 % so, all the services will be costlier by 3-5%.

The common person has to pay services on everything like mobile Bill, DTH bill, Bank charges, Hotels Bill, Transportation etc. So, all will be costlier. This is the biggest effect of GST on common persons.

How Products and Services react after the GST and how the prices will affect is the biggest question in everyone’s Mind.

However, the products were earlier EXCISE and VAT both are applicable has to pay about 32-40% tax to the government and there is a big relief because of the GST. Like Small Cars, Cement sector, Cinema Halls, consumer durable Like Fridge, television etc. So there are good effects of GST on Products and services.

Whenever there is a statuary change will happen is always painful for a shorter period but in the end, it will give always-fruitful results. No one knows what will be the rate of GST while the government of India assures that it will be in the reach of everyone.

Especially the prime minister of India Shri Narendra Modi assures that all the products and services that are the basic need of poor will kept out of the GST and GST will not affect those. He also says this is a very good change going to happen in India. We all will see the best result of GST effect.

We all were discussing the advantages and Disadvantages of GST. However, PM clarifies that there are only the benefits of GST and it will ease the business in INDIA.

Also Read